philadelphia transfer tax form

If no sales price exists the tax is calculated using a formula based on the property value determined. REV-715 -- Realty Transfer Tax Monthly Report.

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

Revenue Code Chapter 91 -- Revenue Code - Chp 91.

. Enter the name address and telephone number of party completing this form. If you are selling or transferring your business you must file a Change Form in order to cancel your tax liability with the City. Ad Download Or Email Form 82-127 More Fillable Forms Register and Subscribe Now.

Enter the date on which the deed or other document was accepted by the Partyies. THIS STATEMENT MUST BE SIGNED BY A RESPONSIBLE PERSON CONNECTED WITH THE TRANSACTION. INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section A Correspondent.

To begin the form utilize the Fill camp. Philadelphia transfer tax form real estate. 2 x 100000 2000.

The new owner must apply for a new Tax Account Number and a new Business privilege License. Is the deed transfer tax exempt. 693 - Form Made Fillable by eForms SEE REVERSE INSTRUCTIONS FOR COMPLETING PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION Section ACorrespondent.

PA Realty Transfer Tax and New Home Construction. Attach additional sheets ifnecessary. 2 X 100000 2000.

REV-1651 -- Application for Refund PA Realty Transfer Tax. SECTION B Enter the full names and addresses of all grantorslessorsand all granteeslessees. This property is exempt from any relevant local or special taxations.

Philadelphia Transfer Tax Exemption. We use cookies to improve security personalize the user experience enhance our marketing. REV-183 -- Realty Transfer Tax Statement of Value.

Wait in a petient way for the upload of your Philadelphia Real Estate Transfer Tax Certification - City Of Philadelphia. PHILADELPHIA REAL ESTATE TRANSFER TAX CERTIFICATION 82-127 Rev. Hit the Get Form Button on this page.

Stay away from spending unneeded time use only up-to-date and accurate form templates by US Legal Forms experts. The city of Philadelphia has an 800 percent sales tax rate which is made up of 600 percent Pennsylvania state sales tax and 200 percent Philadelphia County sales tax. Get the free philadelphia realty transfer tax form 2011-2022 Get Form Show details Hide details A statewide list of the factors is available at the Recorder of Deeds office in each county.

If you dont have an account yet register. The way to complete the Philadelphia form transfer taxsignNowcom 2011-2019 online. Section B Transfer Data.

INSTRUCTIONS FOR COMPLETING REALTY TRANSFER TAX STATEMENT OF VALUE SECTION A Enter the name address and telephone number of partycompleting this form. You should be aware that typically there are both state and local transfer taxes associated with this type of transaction in addition to recording fees. The consideration is not stated in total on the face of the document it must either be stated or explained on the philadelphia real estate transfer tax certification and state statement of value forms.

Philadelphia Pennsylvania Realty Transfer Tax Statement of Consideration Download the form youre searching for from your website library. Click Download to download the changes. Get Form Download the form.

The State of Pennsylvania charges 1 of the sales price and the municipality and school district USUALLY charge 1 between them for a total of 2 ie. 2 rows When you complete a sale or transfer of real estate that is located in Philadelphia you must. Enter the name address and telephone number of party completing this form.

2 x 100000 2000. Sign Online button or tick the preview image of the blank. A Corporation or Association that qualifies as a Real Estate Company must file a Declaration of Acquisition form within thirty 30 days after becoming an Acquired Company as defined in 72 PS.

Recently taxpayers have taken advantage to substantial discrepancies between assessed and market values to lower. Attach a complete copy of the trust agreement and identify the grantors relationship to each beneficiary. This transfer tax is traditionally split between the buyer and the seller with each.

Effective october 1 2018 the transfer tax for the city of philadelphia is 3278 with an additional state of pennsylvania tax of 1 for a total of 4278. Fill Sign Philadelphia Form Transfer Tax 1993. You can erase text sign or highlight as what you want.

How is Philadelphia transfer tax calculated. Philadelphia Real Estate Transfer Tax. REV-1728 -- Realty Transfer Tax Declaration of Acquisition.

Philadelphia PA 19102 215 686-6442 Real Estate revenuephilagov 215 686-6600 Taxes. The advanced tools of the editor will direct you through the editable PDF template. Enter your official identification and contact details.

And estate file number in the space provided. Think of the transfer tax or tax stamp as a sales tax on real estate. This link will take you to a sales tax table with an 800.

Philadelphia beginning July 1 2017 will begin to tax transfers of interests in real estate entities based on the selling price of the entity rather than the computed value assessed value102 of the realty. Effective October 1 2018 the transfer tax for the city of Philadelphia is 3278 with an additional state of Pennsylvania tax of 1 for a total of 4278. Sell or transfer a business.

8102-C5 in every county in which the corporation or association owns real estate. Enter the name address and telephone number of party completing this form. Nominal consideration or under the intestate succession.

Philadelphia County Quit Claim Deed Form Pennsylvania Deeds Com

10 Complaint Letter Samples Word Excel Pdf Templates Letter Templates Free Letter Templates Lettering

Philly Realty Transfer Tax What Is It And How Does It Work Department Of Revenue City Of Philadelphia

Why Was My Refund Request Denied Answers To Frequent Wage Tax Questions Department Of Revenue City Of Philadelphia

United Bank Of Philadelphia Review Black Owned Low Minimum Deposits

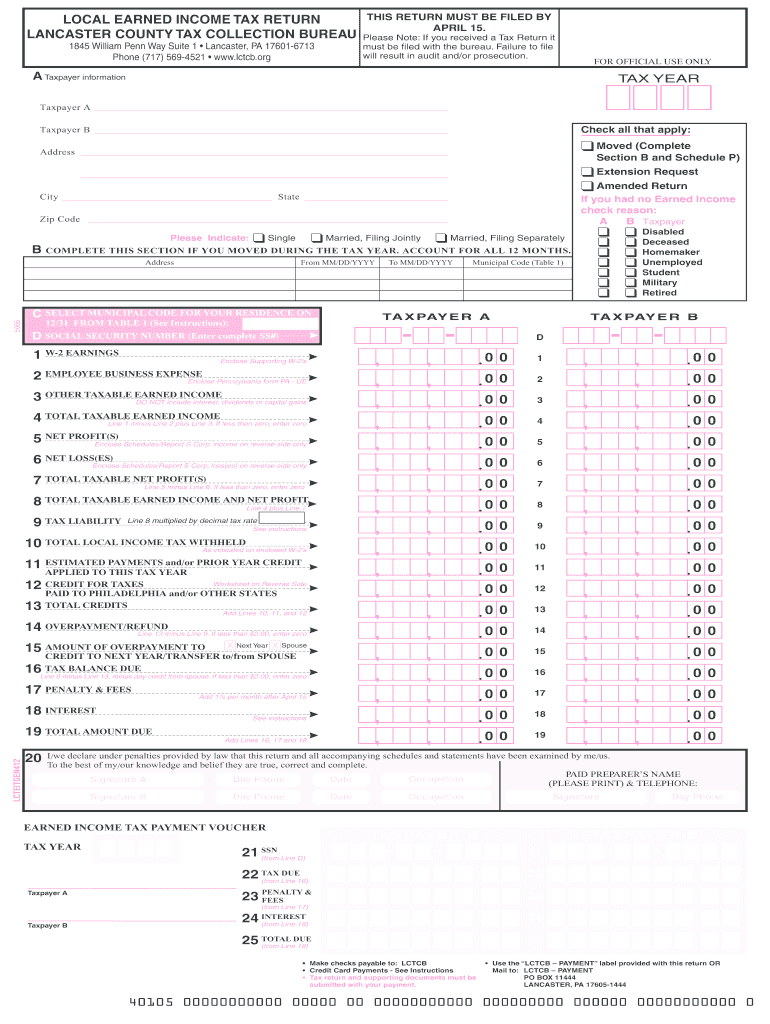

Pa Local Earned Income Tax Return Fill Out Tax Template Online Us Legal Forms

Deed Fees In Philadelphia County Pennsylvania

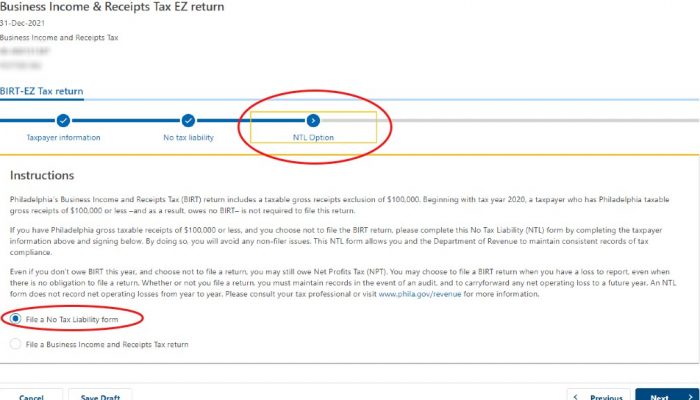

You Pay Lots Of Philly Taxes But Do You Know Why Philadelphia Magazine

Four Philadelphia Taxes Due On April 18 Department Of Revenue City Of Philadelphia

Check The Po Box Mailing Tax Payments Forms To Revenue Department Of Revenue City Of Philadelphia

Real Estate Transfer Tax In Philadelphia Real Estate Lawyer Pa

Nfl Stadiums Map Poster Etsy Nfl Stadiums Map Poster Nfl

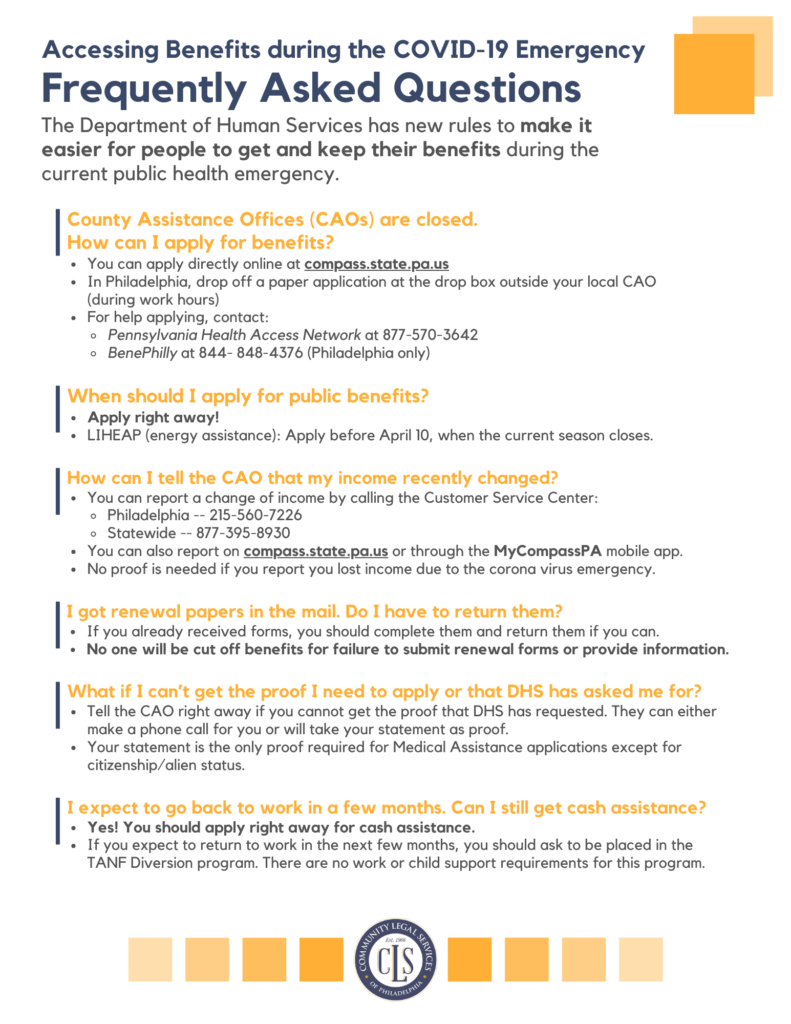

Coronavirus Bulletin Board Aids Law Project

Philadelphia County Quit Claim Deed Form Pennsylvania Deeds Com

Boat Sale And Purchase Agreement Template Nz The Seven Secrets About Boat Sale And Purchase Cars For Sale Project Cars For Sale Cars For Sale Used

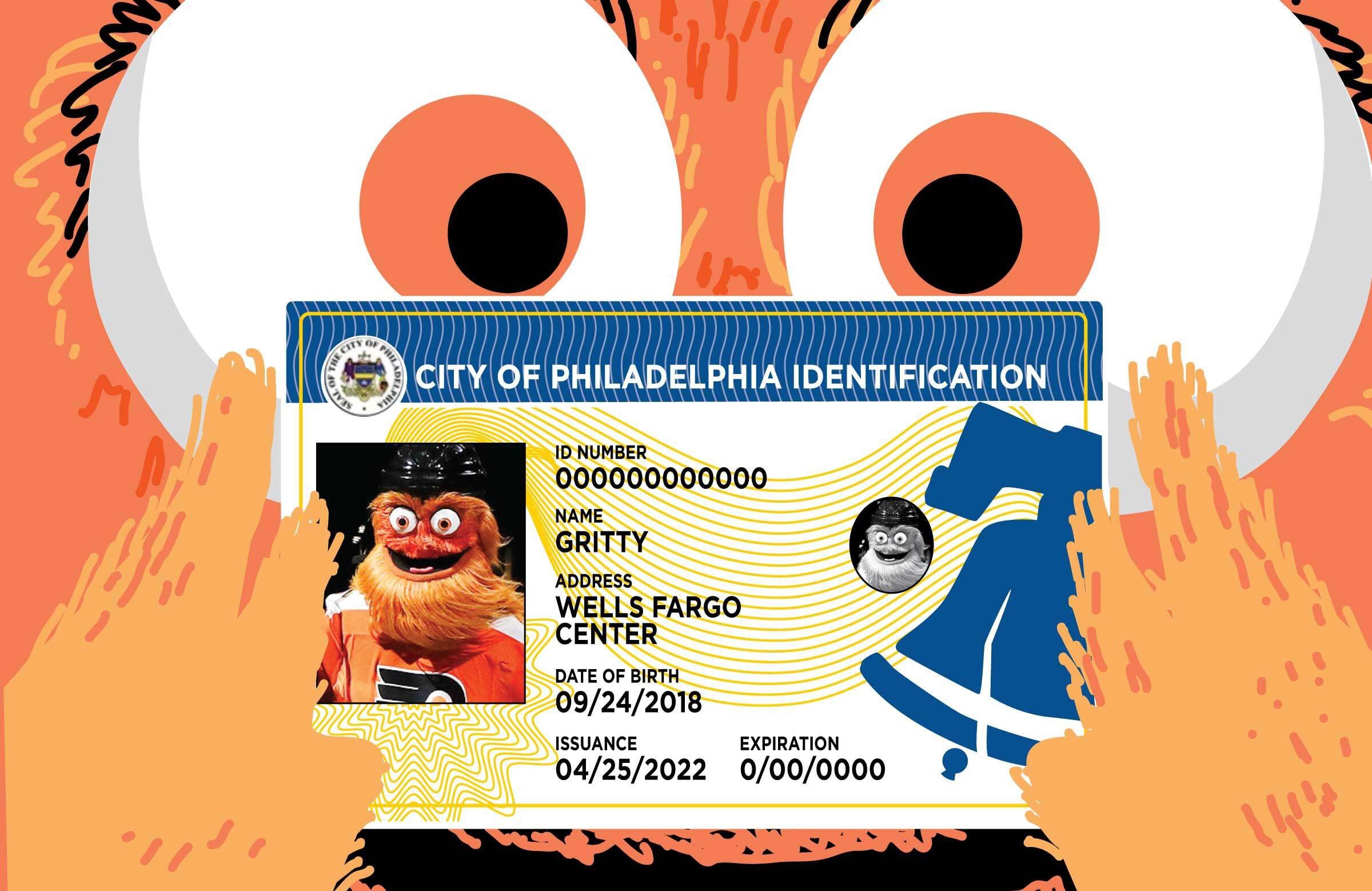

How To Get A Government Id In Philly

Pennsylvania Quit Claim Deed Form Quites The Deed Nevada

/cloudfront-us-east-1.images.arcpublishing.com/pmn/TZZDO7RSIRG2PEDQSYWI3UY4AI.jpg)

How To Get A Government Id In Philly

Philadelphia Family Court Forms Fill Online Printable Fillable Blank Pdffiller